The advent of the Informa-

tion and Communication

Technologies (ICTs) has

not only changed ways

of living but also our ways of

doing things. Ever since Came-

roon embraced the ICTs, a lot

of reforms have been intro-

duced in the domain of doing

business in both the public and

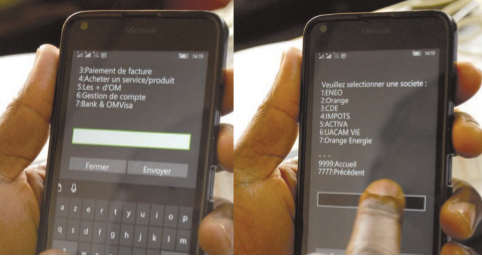

private sectors. At just a click,

a moral or physical person can

conveniently declare his taxes

for instance. Within just two

hours, an aspirant entrepre-

neur can create an enterprise

online (www.mybusiness.cm).

Also at the pilot One Stop Shop

Enterprise Creation Centres

located in Garoua, Douala and

Yaounde, it now takes just 72

hours maximum to create an

enterprise. Given the simplifi-

cation of procedures, some 15,

219 enterprises were created

in 2016. In the first quarter

of 2017, a total of 597com-

panies were created, 593 of

them owned by nationals and

four by foreigners according

to statistics published by the

Ministry of Small and Medium

Size Enterprises, Handicraft and Social Economy (MINPMEESA)

these reforms introduced in

various public administration

such as the Customs, Taxation,

Treasury, Small and Medium

Size Enterprises, Handicraft

and Social Economy, Public

contracts (e-procurement

system) in by Cameroon in the

recent years has multi-face-

ted advantages ranging from

curbing corruption, improving

the business climate amongst

others.

One of the far reaching ad-

vantages of materialisation

of procedures is stemming

corruption as physical contact

and bureaucratic procedures

are eliminated. In an interview

published by a local tabloid on

May 24, 2017 the Director General

of the Treasury, Financial and

Monetary Cooperation in the

Ministry of Finance, Sylvester

Moh, admitted that reforms in

that public administration has

reduced corruption to the barest

minimum. The payment made

to State suppliers, he noted has

moved from 90 to 60 days and

it is done chronologically. He

intimates that suppliers need

not come to their offices to

chase files but can consult the

website www.dgtcfm-cm to

verify the evolution of their

files which if validated must

be paid within 60 days. Came-

roon’s taxation department

was a few years back accused

by anti-grafts watchdogs as a

breeding ground for corruption.

Today, physical contacts have

been greatly reduced as tax

payers can pay their dues online

(teledeclaration). Attestation

for tax payme...

1 minute is enough to subscribe to Cameroon Business Today Digital!

-

Your special Cameroon Business Today issue in digital version

-

Inserts

-

Exclusive calls for tenders

-

Preview (access 24 hours before publication)

-

Editions available on all media (smartphone, tablets, PC)

Commentaires